DIGITAP.AI provides high tech advanced AI / ML solutions to new-age internet driven businesses for reliable, fast, and 100% compliant Customer Onboarding, Automated Risk Management along with Big Data enabled services like Risk Analytics and Customized Scorecards. Our proprietary Machine Learning Algorithms and Modules provide one of the best success rates in the market.

Working with the largest digital lenders in India, the team brings together deep and vibrant experience in Fintech Product & Risk Management, Management Consulting, and Consumer Retail / eCommerce Business.

The service we offer is specifically designed to meet your

needs.

Onboarding Suite: End-to-end APIs for digital onboarding of

customers including Aadhaar-based KYC, OCR & validation of

KYC docs, and Video KYC.

Alternate Data Suite: Various solutions to assess the credit worthiness of a customer based on alternate data sources such as Bank statements, Device data, Ecom data, social media data, and Telecom data.

TSP for Account Aggregator: Digitap is a certified TSP providing FIU module with integrations to all Account Aggregators. We also provide variables necessary for credit underwriting.

Expense Manager: Digitap’s SDK allows our clients to access the expenses of their customers where we also provide personalized and contextualized insights for cross-sell of various products.

The most challenging issue for Digitap.ai is that although they have generated a significant number of deals with companies in the BFSI industry in India, it is proving difficult to convert these deals into closed business. This is due to the high level of competition in the market and the presence of other vendors offering similar AI services. By identifying the right stakeholders and crafting tailored communication, HungerBox was able to enhance its client acquisition process and strengthen its market positioning.

To overcome market barriers and establish itself as a leading player in the competitive BFSI industry, Digitap.ai is prioritizing the marketing of its unique services, including Customer Onboarding, Automated Risk Management, and Big Data-enabled services like Risk Analytics and Customized Scorecards. By highlighting these distinct offerings, Digitap.ai aims to differentiate itself from its competitors and generate interest among potential customers.

Indian fintech start-up Digitap.AI have reportedly teamed up to strengthen the credit underwriting process. Digitap.AI, which is a data based risk management solutions provider, will allow businesses to access customers’ bank statements.

They offer video-based customer due diligence, customized technology services, and proactive support, which have helped businesses scale up quickly and launch new initiatives smoothly. Their solutions and customer-centric approach offer a range of opportunities for businesses looking to enhance their operations, improve customer satisfaction, and grow revenue. They have 99% Customer Satisfaction in the BFSI industry with 85+ clients. Most of the companies have generated 3x revenue growth with Digitap.ai.

WHY INTANDEMLY?

Digitap.ai, a leading provider of AI powered solutions in the BFSI industry, is looking to expand its reach and boost its sales efforts.

In an effort to enhance its sales funnel and achieve its vision for 2022, Digitap.ai has conducted extensive research on sales procedures and strategic methods. Through this process, they have identified Account Based Marketing as the optimal approach to promote their brand and drive meeting replies. Digitap.ai has partnered with Intandemly, a trusted name in marketing and sales enablement. Through this collaboration, Digitap.ai aims to leverage Intandemly’s expertise in Account-Based Marketing to target key accounts and deliver personalized messages to drive engagement and interests

Solutions

Intandemly, a trusted name in marketing and sales enablement has developed a comprehensive plan to help Digitap.ai achieve its sales goals.

This plan is based on Intandemly’s high-quality standards and takes into account Digitap. Ai’s unique requirements and objectives.

Intandemly added an SDR along with a data miner to extract and develop the database and a Sales Operation Manager who oversees the workflow and assures deliverability. In the context of ABM, Intandemly employs a range of strategic methods to ensure success. This includes:

Account selection: Intandemly helps clients identify and prioritize high value accounts based on their specific goals and objectives.

Personalization: Intandemly creates customized messaging and content that is tailored to the specific needs and pain points of each target account.

Multi-channel approach: Intandemly employs a multi channel approach to reach target accounts through various channels, including email, social media, and targeted advertising.

Metrics and reporting: Intandemly provide detailed metrics and reporting on campaign performance, allowing clients to track progress and make data driven decisions.

Sales enablement: Intandemly works closely with clients’ sales teams to ensure that they are equipped with the information and resources needed to close deals.

RESULTS

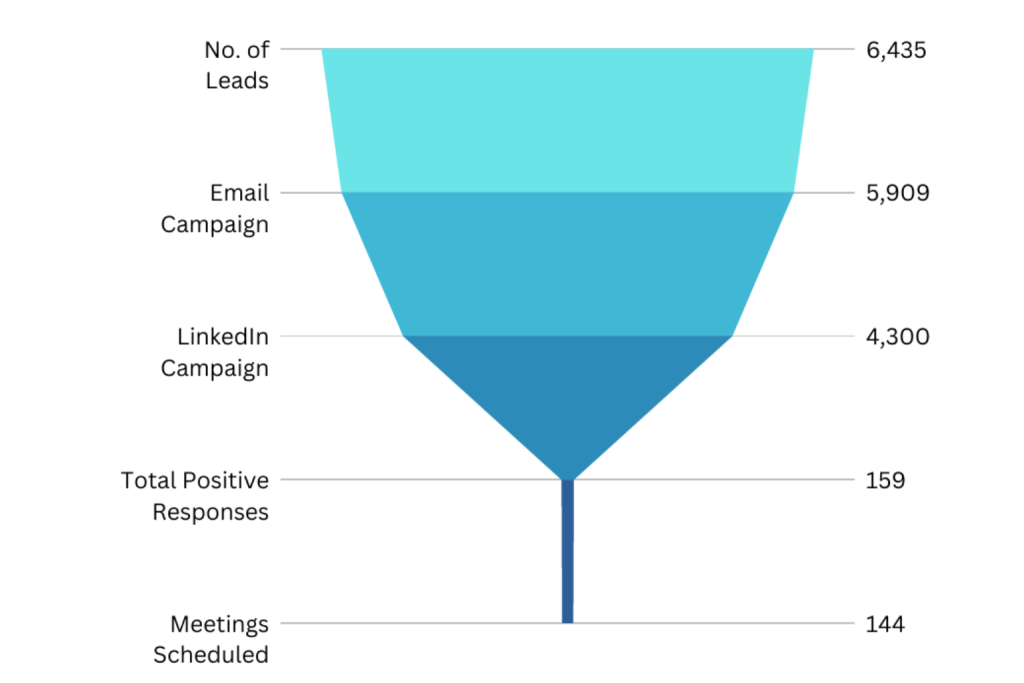

The below-mentioned results are based on the figures that SDR and data miners collaborated on. Whereas SDR focuses solely on qualifying and targeting accounts, data miner creates a database from qualified accounts.

Digitap’s partnership with

Intandemly is poised for continued success and growth in the years to come.

NAGEEN KOMMU

FOUNDER AND CEO, DIGITAP

Intandemly helps B2B companies identify, engage, and convert high-value accounts with a powerful blend of AI precision and human expertise.

©2025. All Rights Reserved.